A Word on Inverted Yield Curves

Recently, there’s been all kinds of buzz about this thing called the “inverted yield curves” It happened on August 14 while the markets were cattywonkus, so it got a lot of people worried about a recession.

But in listening to friends and media wonks talk about the yield curve, I got to thinking….maaaaaybe a little education is in order.

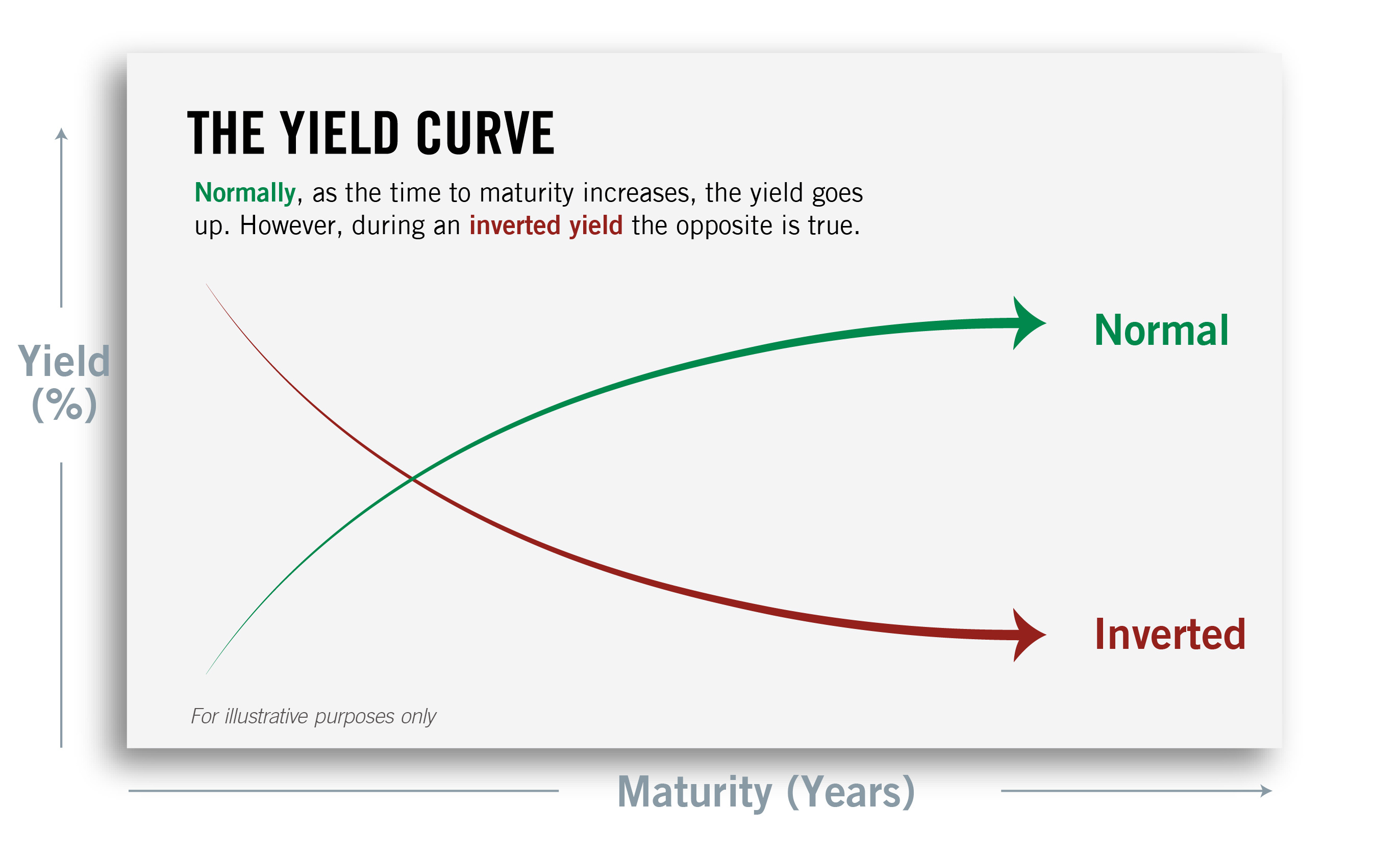

A yield curve is a graph with short-term interest rates on the left and long-term interest rates on the right. The graph slopes up to the right when long-term rates are higher than short-term ones. That’s normal.

A yield curve inverts when long-term interest rates sink below short-term ones, which is unusual.

Back in the day, when I was an active day trader in the equities market, I used to obsess overdramatic sell-offs, yield curves, and the like. So I get it. I understand why these things can cause heartache. And uncertainty just causes MORE heartache.

So, to clear up some of the uncertainty (heartache!), please keep these things in mind about yield curves:

1. While every recession over the last 40 years has been preceded by an inverted yield curve, a recession hasn’t followed every inverted yield curve.

2. Most experts say last August’s inversion, which lasted 2 hours and 15 minutes, didn’t last long enough to warrant panic.

3. The yield curve has gotten a lot less, well, curvy, over the last 30 years. It’s pretty close to sloping downward in normal times. So, according to an economic note published by the Federal Reserve Bank of Richmond last December, it will invert more often “…even if the risk of recession has not increased at all.” Alexander Wolman, an economist, and VP at the Richmond Fed pointed out in a paper about the yield curve and its disappearing slope: an inversion “…is less likely to be a predictor of recession than it used to be.”

I’m not saying there’s nothing to worry about. Maybe there is. But I’ve learned—from personal experience and from all that I read—the keyword is “maybe.”

My advice: stay focused, chill out, be educated, and enjoy your day.

Click here to read a little more about yield curves.

Click here to contact me and find out why I eventually threw in the trading towel and went all-in on real estate notes.

Call 844-433-6683 or email info@fallerfinancial.com to sell your mortgage note or request a consultation at fallerfinancial.com/contact.