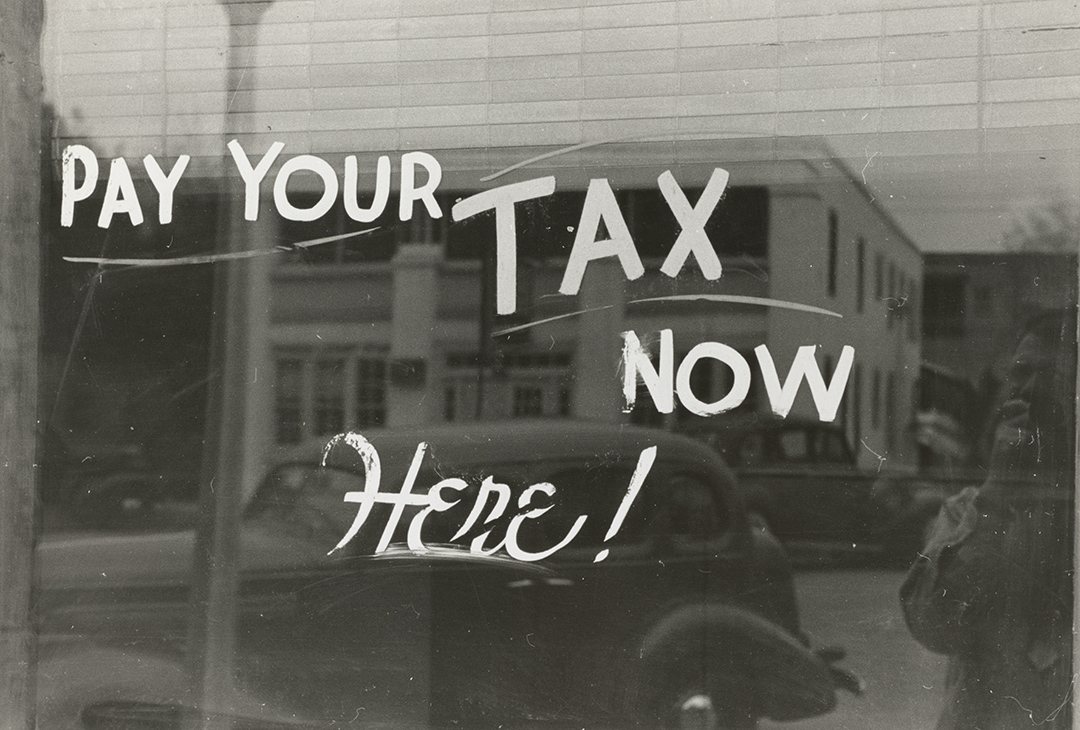

What the heck is a tax lien?

The technical definition is: A lien is the right to keep possession of a property belonging to another person until the debt owed by that person is discharged.

But…does that make sense to you? Yeah, me neither.

Here’s how I describe it: A lien is a legal mark on an asset, like a property, that serves as a guarantee the underlying financial obligation will be met. In other words, it’s the thing saying, “Cody will pay off his mortgage…and if he doesn’t, a lien will be placed on the property enabling the bank/lender to seize his property.”

There are actually many types of liens used to secure assets but I’ll expand here on one that’s especially relevant in the Notes biz: tax liens.

Back in the day (not sure when, exactly), state governments came up with a solution for homeowners that don’t pay their taxes. They sell the deed or lien to investors often through an auction process. There are 31 tax deed states where the deed is actually sold due to back taxes, and it transfers full ownership of the property. In other states, delinquent taxes are turned into tax liens, and tax liens are sold during the year at different intervals depending on the state.

Taxes can generally be redeemed prior to the expiration of the redemption period, which varies by county or state.

Note holders want to protect their investments and ensure any sold taxes are redeemed prior to the expiration of the redemption period. The process of requesting a tax lien pay off varies.

Lenders also have to be aware of municipal liens, resulting from non-payment of utility bills or code violations.

To learn more in general about Faller Financial and Notes, go to fallerfinancial.com/note-resources.

Call 844-433-6683 or email info@fallerfinancial.com to sell your mortgage Note, or request a consultation at fallerfinancial.com/contact.

Photo by The New York Public Library on Unsplash