A couple of weeks ago, St. Louis Federal Reserve President James Bullard told CNBC he sees an initial interest rate increase happening in late-2022 due to inflation picking up faster than previous forecasts had anticipated.

He promptly cautioned everyone to take his words with a grain of salt because the reasons behind the projected rate hike are highly speculative.

Basically: “This is what I think…but none of it may come true.”

Nonetheless, he has a big brain, a big job, and he was touching on a big topic: yield.

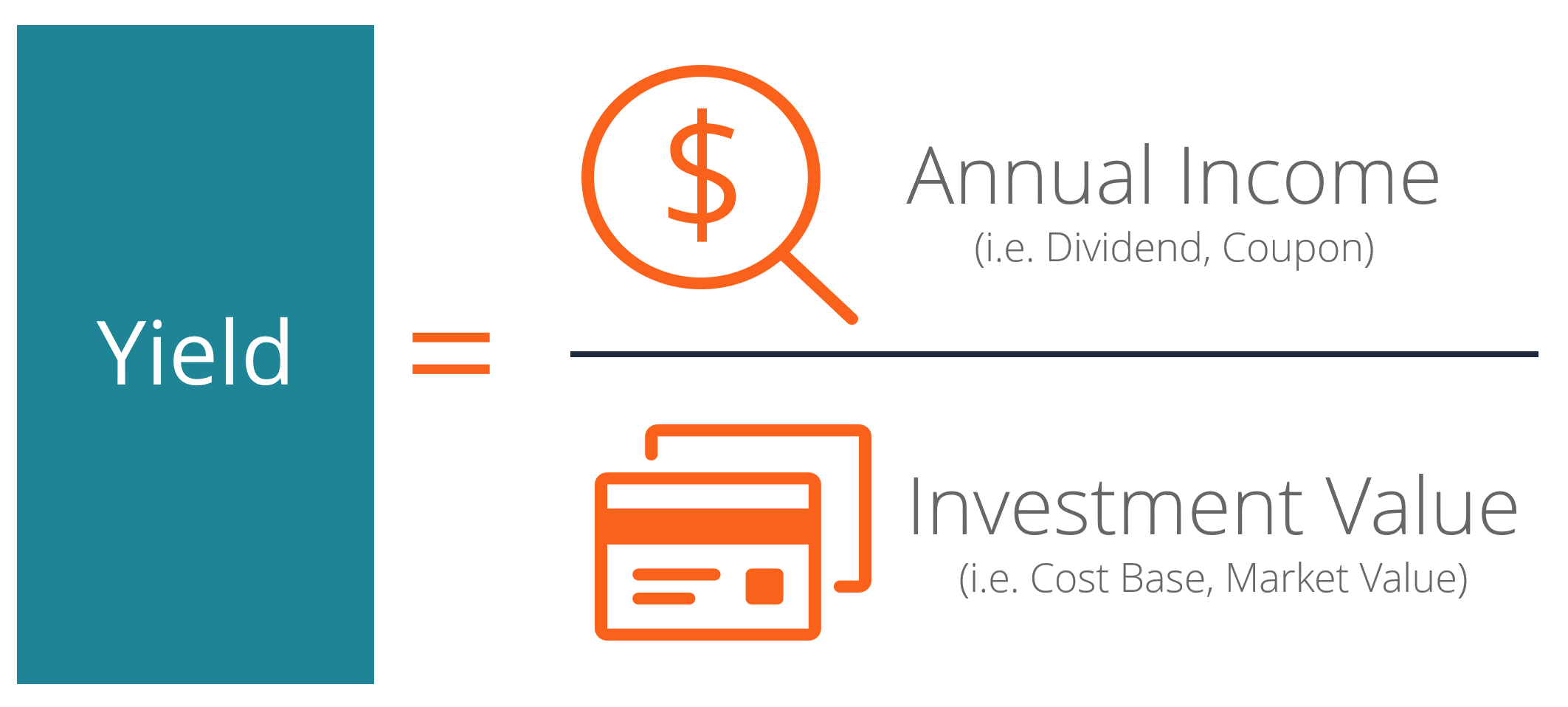

Interest rates impact investment yields—the cash flow returned to investors, typically expressed on an annual basis.

Low-interest rates often result in lower yields. Not always, depending on your portfolio, but that’s certainly the case for many investors right now.

So when Mr. Bullard speculates that interest rates could inch up sooner, that’s important. Yield is hard to get right now but maybe it’ll become easier in the potentially-sooner-than-later future. Maybe.

Shameless plug!

As I just mentioned, some investors realize decent yields even when interest rates are low.

Historically, Faller Financial’s cash-flowing Note investments have provided 8% yield. Needless to say, our investors LOVE that number. Especially now. It’s a historical number, so it doesn’t guarantee anything going forward, but it substantiates the thesis we’ve been sticking with for years: Notes, done right, can be very attractive, steady-eddy investments…especially during volatile, low-interest market conditions. Let us know if you like investments that have a history of steady-eddy returns.

NOTE: PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS. INVESTING INVOLVES RISK.

Note Selling Invitation

Faller Financial is growing. We are currently seeking real estate Note sale opportunities worth $5MM or greater.

Sell Your Note(s)

Call: 844-433-6683; email: info@fallerfinancial.com; fill out our form: fallerfinancial.com/contact

Learn More

fallerfinancial.com/note-resources

Image: corporatefinanceinstitute.com