Know-How Note Buyers Value Your Property

Coming up with the value of a mortgage Note includes valuing the property the mortgage is tied to. And the process is both art and science…but mostly science. Even during times of a pandemic.

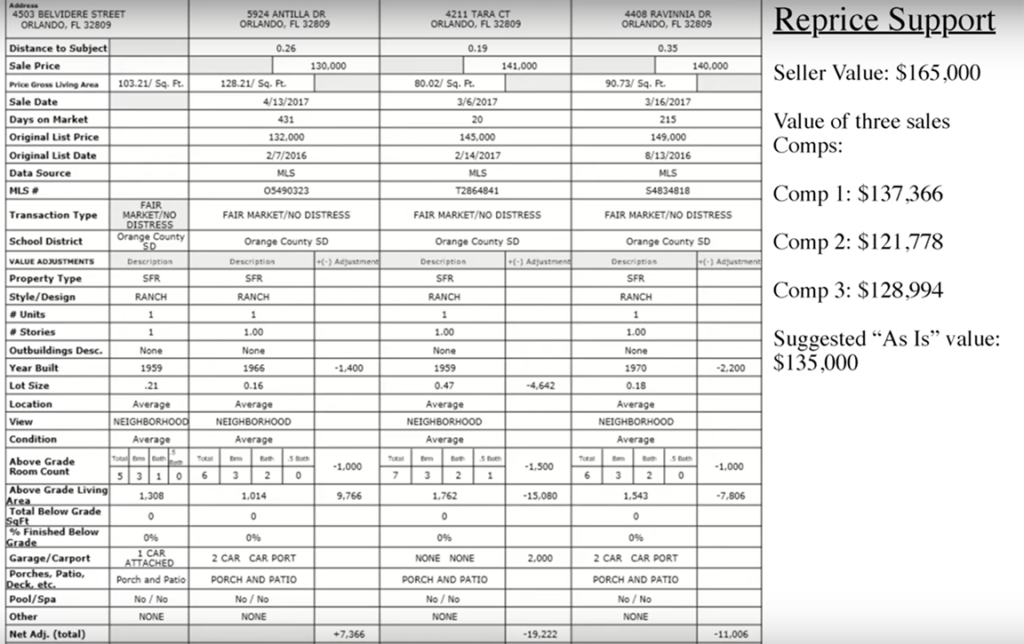

A property is worth what a buyer is willing to pay. Simple as that. So the primary tool for determining a property’s potential value is by looking at comparable sales.

Another method is by doing a full appraisal, when an appraiser visits the home, takes pictures and measurements, and evaluates the condition of the entire property. However, most properties in the Note business are not valued using this approach because borrowers are typically occupying the home. And last we checked, people don’t like super-sleuthing appraisers plodding around their home with a clipboard and tape measure.

Even if the home is vacant, in the case of a foreclosure, it isn’t always legal to enter the home. So most Note investors rely on public data, often performing an automated valuation model (AVM), which doesn’t require anyone to physically inspect the property.

An AVM is commonly referred to as a desktop valuation and it’s used today as an inexpensive but sometimes less accurate methodology—compared to a Broker Price Opinion (BPO). A BPO is when a hired sales agent determines the potential selling price or estimated value of a property by performing a “drive-by,” physically driving by the property.

So, back to comparable sales. The best way to know how much an investor may value your Note’s property is by looking at relevant comps. Keyword: relevant.

Ignore properties that aren’t really comparable. Significant value variations occur once you move beyond certain streets or neighborhoods.

A great example of this is when one side of the street has a view, looking out to a lake, and the other side looks out to a nuclear plant. Okay, maybe that’s a bad example; I’m guessing any lake near a nuclear plant isn’t the most picturesque thing. You get the point. A great way to view potential value variations is by bringing up the property online through aerial views with Google Maps or Google Earth.

Other online tools for performing desktop appraisals include Zillow.com, RedBellre.com, Homesnap.com, Realtor.com, or moveup.com.

Keep in mind, while desktop appraisals can be useful for getting a preliminary value and a feel for the neighborhood, an investor’s final value will likely include the input from multiple realtors who are familiar with the area.

So…to summarize: experienced Note investors value residential real estate using subjective and objective factors, relying heavily on relevant comparable sales.

Be well! And if you’re interested in selling your mortgage Note—increasing cash flow and liquidity—reach out.Sell Your Note