Mortgage Note Seller – How to be a Great One.

Life has changed for mortgage seller. The first three months of 2020 now seem like a distant memory. Everything’s different, with COVID-19 creeping into all of our lives.

Some of the things that haven’t changed are the stuff that makes for a great mortgage Note sale.

Earlier this year, in a post titled “How to be a SuperNote Seller,” we advised individual sellers on the following:

1. Know the value of the remaining payments (on the Note).

2. Know the value of the property/collateral.

3. Know the credit score of the borrower (i.e. the person making the payments).

4. Know the payment history or “seasoning.”

All of these things still hold true. But it’s worth re-emphasizing one important point: better data = better sales.

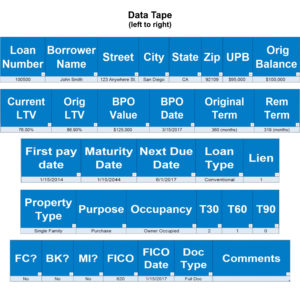

The best Note sellers—who get top dollar for their Notes—are more organized with their data and collateral. It’s all accurate and current. Providing a comprehensive and precise data file (often called “data tape”) when selling is like detailing your car before you sell, or cleaning your home before an open house.

A “data tape” is a Microsoft Excel spreadsheet with a bunch of columns (pictured). It includes everything from the loan number to important dates to the borrower’s FICO score. It is THE data any buyer will want and need. Several of the abbreviations to know:

UPB = Unpaid Principal Balance (the current principal balance on the loan)

LTV = Loan to Value (loan value and how much equity is in the property)

BPO = Broker Price Opinion (a broker’s opinion on the value of the property)

FC = Foreclosure

BK = Bankruptcy

Again, if you don’t remember anything about this post, remember this: better data = better sales.

Be well! And if you’re interested in selling your mortgage Note—increasing cash flow and liquidity—reach out!

Learn more helpful Note industry tips at https://fallerfinancial.com/note-resources/.