Pay History & Selling a Mortgage Note

Pay history is really really important when it comes to selling a mortgage Note.

Experienced Note buyers like Faller Financial love to see how well the borrower is paying overtime, especially when evaluating a performing loan.

Pay history is also essential for demonstrating a default date to the courts when foreclosing on a non-performing loan. Some states like Florida have been known to require payment history to foreclose.

But (you ask because I know you are interested): what does a COMPLETE pay history consist of? Glad you asked.

Ideally, payment history shows:

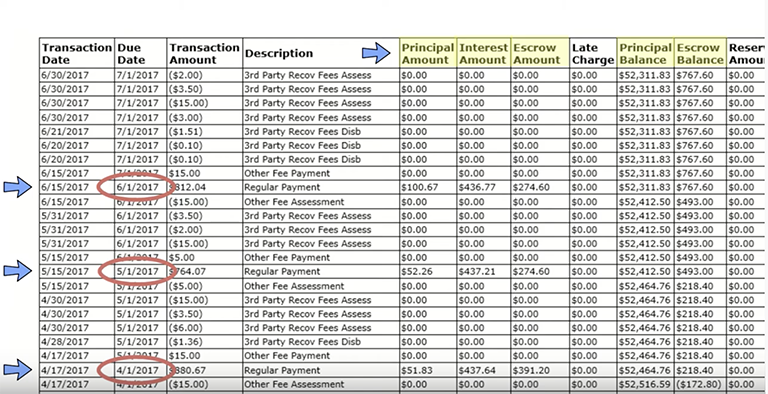

1. The unpaid principal balance (UPB) and the escrow balance, as well as running balances (i.e. those balances updated with every payment on record).

2. A regular payment by the borrower is generally shown and on the history as REG, for regular payment.

3. The transaction date on the history is simply the date the payment was posted and when a regular payment is made. The next due date is typically the month after the specified due date for which that payment was made.

4. Property taxes and the insurance disbursements made by the servicer.

5. Late fees and other loan charges are also included in the payment history.

6. Collection comments, also referred to as servicing comments, are typically created by the loan servicer to document discussions with the borrower and payment details. These are great to have because they may indicate whether or not the borrower has been difficult or uncooperative. They’ll show evidence of filing for bankruptcy and/or Quality Written Requests (QWRs, made by the borrower questioning how the file has been serviced). They’ll also show evidence of prolonged hardships or “promise to pay” details.

Bottom line: pay history is crucial for understanding cash flow and may be required for the foreclosure process (if warranted). And the collection comments provide key details about the borrower.

Be well! And if you’re interested in selling your mortgage Note—increasing cash flow and liquidity—reach out.