This article is Volume 3 of a series about the history of international banking crises and the unfortunate, recurring breakdown in trust. [Check out Volume 1 and Volume 2]

Everyone knows about the Great Depression in the 1930s. Did you know some historians consider the Panic of 1819 to be the first Great Depression?

The U.S. Government borrowed heavily to finance the War of 1812, causing tremendous strain on the banks’ specie reserves.

Specie (noun): money in the form of coins rather than notes.

Anyway, specie payments were suspended in 1814, which violated the government’s obligations to depositors, which led to new banks and banknote issues, which encouraged unsustainable investments.

Enter….the Second Bank of the United States (didn’t know there was such a thing, right?).

The Second Bank of the U.S.—seeing things getting out of control—initiated a sharp credit contraction beginning in the summer of 1818, it halted expansion and started the process of contraction.

Trust in the government, in banking, in bankers, in U.S. ag trade, and everywhere in between evaporated.

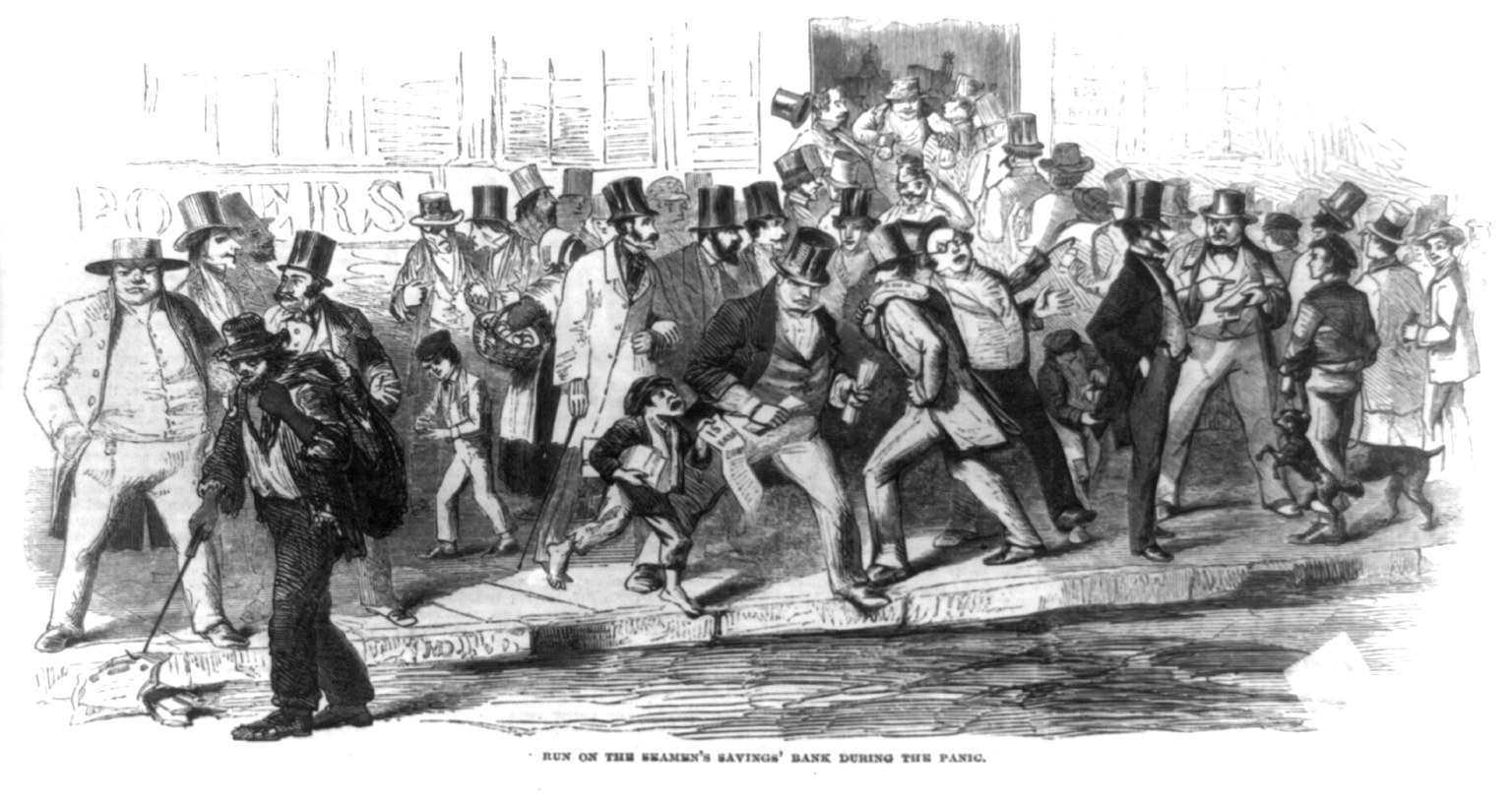

Bankruptcies, bank failures, and bank runs followed. Prices dropped and wide-scale urban unemployment began.

ASIDE: To make matters worse in the early 19th century, Mount Tambora erupted in 1815 (an active stratovolcano on a tiny island in the Flores Sea [look it up]). That led to an up-and-down sequence of ag events globally, which didn’t help the U.S. when the specie and banking issues started.

Ultimately, the American economy collapsed, and it stayed that way through 1821.

To read more about banking crises or to learn more in general about Faller Financial and Notes, go to fallerfinancial.com/note-resources.

Call 844-433-6683 or email info@fallerfinancial.com to sell your mortgage Note, or request a consultation at fallerfinancial.com/contact.

Sources: Wikipedia.org; historytoday.com; bis.org; jhna.org

Photo: Political cartoon depicting a run on a bank during the Panic of 1819