Why Mortgage Notes are Discounted?

There are several reasons a Mortgage Notes buyer like Faller Financial purchases discounted mortgage notes—regardless of whether or not there’s a pandemic going on. Risk is one reason; a big one. But another reason is the time value of money.

[insert head-scratching]

Time value of money (TVM) is a concept that says this: a dollar today is worth more than that same dollar tomorrow. Today, I can put that dollar to work, earning interest in an investment or whatever. But basically discounted mortgage notes, it’s worth more to me today than some time down the road.

During the Note valuation process, we look at the value of the outstanding future payments due on that Note. Keyword: future. As such, based on the TVM, the total value of the Note is discounted.

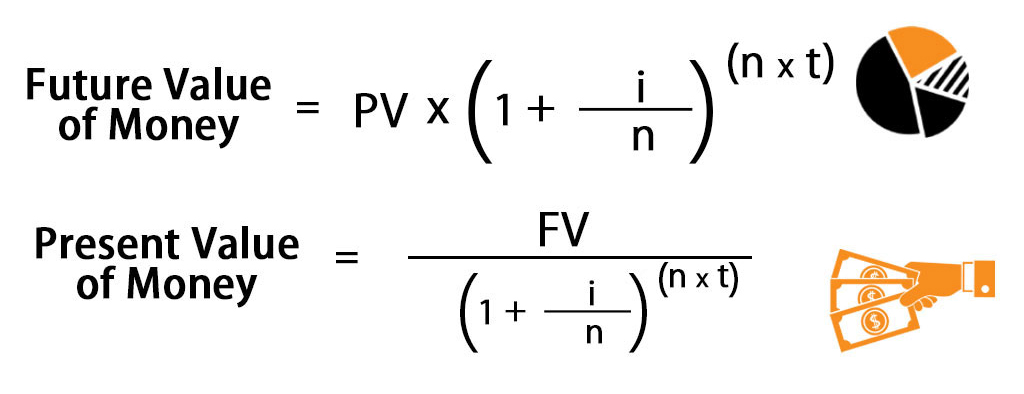

The most fundamental formula for calculating TVM takes into account the following variables:

FV = Future value of money

PV = Present value of money

i = interest rate

n = number of compounding periods per year

t = number of years

Don’t worry about the formula; it’s scary. Let’s focus on a real example.

So, when considering the Present Value of a Note—all things considered (the value of the property, pay history, outstanding payments, and more)—a $100,000 Note in today’s dollars may be valued at $90,000…today.

We asked a committee of self-quarantined citizens (family members) whether or not that makes a LICK of sense, and the overwhelming response was: “Sort of.”

We’ll be the first to admit it can be confusing. But it is a thing and not unique to Faller Financial. So it’s essential to understand if you’re considering selling.

Be well! And if you’re interested in selling your mortgage Note—increasing cash flow and liquidity—reach out.